Forex Technical & Market Analysis FXCC Nov 22 2013

Page 1 of 1

Forex Technical & Market Analysis FXCC Nov 22 2013

Forex Technical & Market Analysis FXCC Nov 22 2013

Forex Technical & Market Analysis FXCC Nov 22 2013

DJIA closes above 16,000 for the first time as dollar yen rises above 101

Today we receive the data concerning Germany's final GDP figure expected in at 0.3% up, with the German IFO index expected in at 107.9. Friday also sees a raft of info. regarding Canada; core CPI data is published expected in flat, with CPI up 0.2%. Retail sales is predicted in up 0.5% for the month. Jolts job openings are published in the USA, it measures the number of job openings during the reported month, excluding the farming industry. The DJIA rose more than 100 points and finally closed above 16,000 for the first time in history on Thursday. The index crossed that psychological milestone earlier this week, but then sold off for three days as the index closed in the red. The S&P 500 also closed up, while the Nasdaq rose more than 1%. The yen fell 1.1 percent to 101.16 per dollar late in New York time Thursday, the weakest level seen since July 10th. Japan’s currency slid 1.4 percent to 136.37 per euro after declining to 136.40, the lowest since October 2009. The euro rose 0.3 percent to $1.3482. The U.S. Dollar Index, which tracks the currency versus 10 major counterparts, rose 0.2 percent to 1,020.97 after advancing 0.4 percent Wednesday. The dollar gauge breached its 100- and 200-day moving averages as it approached a two-month high.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-22 07:00 GMT | DE Gross Domestic Product w.d.a (YoY)

2013-11-22 09:30 GMT | ECB President Draghi's Speech

2013-11-22 13:30 GMT | CA Consumer Price Index (YoY) (Oct)

2013-11-22 13:30 GMT | CA Retail Sales (MoM) (Sep)

FOREX NEWS :

2013-11-22 06:47 GMT | EUR/USD tests highs ahead of German data

2013-11-22 06:34 GMT | GBP/USD nearing upper edge of two-month trading range

2013-11-22 05:39 GMT | USD/JPY retests 101.00 bids, 101.30+ double topside failure

2013-11-22 03:41 GMT | AUD/USD bearish party goes on, 0.92 gives up

EURUSD :

HIGH 1.34895 LOW 1.34624 BID 1.34837 ASK 1.34840 CHANGE 0.02% TIME 08 : 57:07

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further upwards penetration might face next challenge at 1.3495 (R1). Break here would suggest next target at 1.3513 (R2) en route towards to last resistance for today at 1.3530 (R3). Downwards scenario: On the downside, support level at 1.3462 (S1) limits possible downtrend expansion. Break here is required to enable lower target at 1.3444 (S2) en route to final aim at 1.3426 (S3).

Resistance Levels: 1.3495, 1.3513, 1.3530

Support Levels: 1.3462, 1.3444, 1.3426

--------------------

GBPUSD :

HIGH 1.62046 LOW 1.61764 BID 1.61945 ASK 1.61952 CHANGE -0.02% TIME 08 : 57:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: An element of resistive measure could be found at 1.6213 (R1). Clearance here would open way towards to higher target at 1.6242 (R2) and any further rise would then be limited to last resistance at 1.6271 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support barrier at 1.6178 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.6150 (S2) and 1.6122 (S3) in potential

Resistance Levels: 1.6213, 1.6242, 1.6271

Support Levels: 1.6178, 1.6150, 1.6122

--------------------------

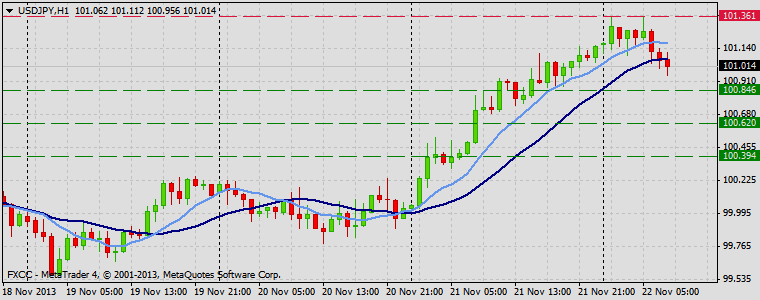

USDJPY :

HIGH 101.353 LOW 100.956 BID 100.997 ASK 100.999 CHANGE -0.15% TIME 08 : 57:10

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow, though a break of our resistance at 101.36 (R1) would suggest next targets at 101.58 (R2) and 101.81 (R3). Downwards scenario: On the other side, a dip below the initial support level at 100.84 (S1) is liable to trigger bearish pressure and drive market price towards to supportive means at 100.62 (S2) and 100.39 (S3) in potential.

Resistance Levels: 101.36, 101.58, 101.81

Support Levels: 100.84, 100.62, 100.39

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

DJIA closes above 16,000 for the first time as dollar yen rises above 101

Today we receive the data concerning Germany's final GDP figure expected in at 0.3% up, with the German IFO index expected in at 107.9. Friday also sees a raft of info. regarding Canada; core CPI data is published expected in flat, with CPI up 0.2%. Retail sales is predicted in up 0.5% for the month. Jolts job openings are published in the USA, it measures the number of job openings during the reported month, excluding the farming industry. The DJIA rose more than 100 points and finally closed above 16,000 for the first time in history on Thursday. The index crossed that psychological milestone earlier this week, but then sold off for three days as the index closed in the red. The S&P 500 also closed up, while the Nasdaq rose more than 1%. The yen fell 1.1 percent to 101.16 per dollar late in New York time Thursday, the weakest level seen since July 10th. Japan’s currency slid 1.4 percent to 136.37 per euro after declining to 136.40, the lowest since October 2009. The euro rose 0.3 percent to $1.3482. The U.S. Dollar Index, which tracks the currency versus 10 major counterparts, rose 0.2 percent to 1,020.97 after advancing 0.4 percent Wednesday. The dollar gauge breached its 100- and 200-day moving averages as it approached a two-month high.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-11-22 07:00 GMT | DE Gross Domestic Product w.d.a (YoY)

2013-11-22 09:30 GMT | ECB President Draghi's Speech

2013-11-22 13:30 GMT | CA Consumer Price Index (YoY) (Oct)

2013-11-22 13:30 GMT | CA Retail Sales (MoM) (Sep)

FOREX NEWS :

2013-11-22 06:47 GMT | EUR/USD tests highs ahead of German data

2013-11-22 06:34 GMT | GBP/USD nearing upper edge of two-month trading range

2013-11-22 05:39 GMT | USD/JPY retests 101.00 bids, 101.30+ double topside failure

2013-11-22 03:41 GMT | AUD/USD bearish party goes on, 0.92 gives up

EURUSD :

HIGH 1.34895 LOW 1.34624 BID 1.34837 ASK 1.34840 CHANGE 0.02% TIME 08 : 57:07

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Further upwards penetration might face next challenge at 1.3495 (R1). Break here would suggest next target at 1.3513 (R2) en route towards to last resistance for today at 1.3530 (R3). Downwards scenario: On the downside, support level at 1.3462 (S1) limits possible downtrend expansion. Break here is required to enable lower target at 1.3444 (S2) en route to final aim at 1.3426 (S3).

Resistance Levels: 1.3495, 1.3513, 1.3530

Support Levels: 1.3462, 1.3444, 1.3426

--------------------

GBPUSD :

HIGH 1.62046 LOW 1.61764 BID 1.61945 ASK 1.61952 CHANGE -0.02% TIME 08 : 57:08

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: An element of resistive measure could be found at 1.6213 (R1). Clearance here would open way towards to higher target at 1.6242 (R2) and any further rise would then be limited to last resistance at 1.6271 (R3). Downwards scenario: Any downside fluctuations remains for now limited to the next support barrier at 1.6178 (S1). Only clear break here would be a signal of possible market easing towards to our targets at 1.6150 (S2) and 1.6122 (S3) in potential

Resistance Levels: 1.6213, 1.6242, 1.6271

Support Levels: 1.6178, 1.6150, 1.6122

--------------------------

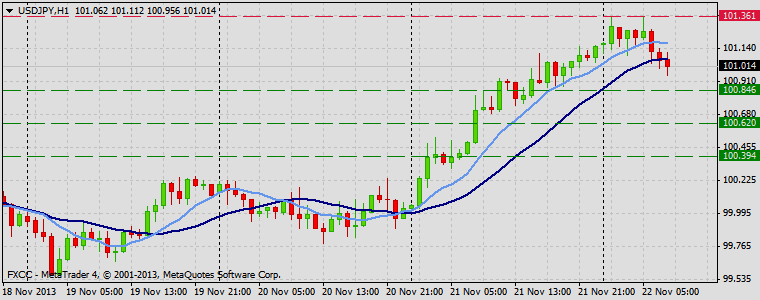

USDJPY :

HIGH 101.353 LOW 100.956 BID 100.997 ASK 100.999 CHANGE -0.15% TIME 08 : 57:10

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Market players may prefer to stay neutral today during limited tier one macroeconomic data flow, though a break of our resistance at 101.36 (R1) would suggest next targets at 101.58 (R2) and 101.81 (R3). Downwards scenario: On the other side, a dip below the initial support level at 100.84 (S1) is liable to trigger bearish pressure and drive market price towards to supportive means at 100.62 (S2) and 100.39 (S3) in potential.

Resistance Levels: 101.36, 101.58, 101.81

Support Levels: 100.84, 100.62, 100.39

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Similar topics

Similar topics» Forex Technical & Market Analysis FXCC Apr 26 2013

» Forex Technical & Market Analysis FXCC May 16 2013

» Forex Technical & Market Analysis FXCC Jun 10 2013

» Forex Technical & Market Analysis FXCC Nov 15 2013

» Forex Technical & Market Analysis FXCC Jul 22 2013

» Forex Technical & Market Analysis FXCC May 16 2013

» Forex Technical & Market Analysis FXCC Jun 10 2013

» Forex Technical & Market Analysis FXCC Nov 15 2013

» Forex Technical & Market Analysis FXCC Jul 22 2013

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum