Forex Technical & Market Analysis FXCC Oct 22 2013

Page 1 of 1

Forex Technical & Market Analysis FXCC Oct 22 2013

Forex Technical & Market Analysis FXCC Oct 22 2013

Forex Technical & Market Analysis FXCC Oct 22 2013

Tuesday's NFP day, let's be careful out there

The big event of the day is the 18 day late publication of the NFP figures. Traders need to exercise caution as the figure might come in far better than predicted, but be subject to significant revisions due to the temporary govt. shutdown. The anticipation is for a print of 182K jobs created with the unemployment rate remaining steady at 7.3%. The benchmark 10-year yield rose two basis points, or 0.02 percentage point, to 2.60 percent as of 5 p.m in New York. The price of the 2.5 percent note due in August 2023 fell 6/32, or $1.88 per $1,000 face amount, to 99 1/8. The yield declined to 2.54 percent on Oct. 18th, the lowest since July 24th, down from a 2013 high of 3 percent on Sept. 6th.Treasury 10-year notes snapped a three-day advance before the NFP government report on Tuesday.

The yen fell 0.5 percent to 98.19 per dollar after gaining 1.1 percent during the previous two days. Japan’s currency declined 0.4 percent to 134.32 per euro and touched 134.38, the weakest level since Sept. 23rd. The dollar was little changed at $1.3681 per euro after gaining 0.3 percent earlier. The U.S. Dollar Index, which monitors the greenback versus a basket of 10 other major currencies, rose 0.2 percent to 1,004.55 late in New York. The gauge fell to 1,000.70 on Oct. 18th, the lowest intraday level since Feb. 13th, extending a weekly loss to 1 percent, the most in a month. The price of crude oil fell below $100 a barrel Monday after the U.S. government reported an increase in supplies. Metals prices were broadly higher and crop prices were mixed. Crude oil for November delivery fell $1.59, or 1.6 percent, to $99.22 a barrel in New York. That's the first close below $100 a barrel since July.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-22 08:30 GMT | UK Public Sector Net Borrowing (Sep)

2013-10-22 12:30 GMT | US Nonfarm Payrolls (Sep)

2013-10-22 12:30 GMT | CA Retail Sales (MoM) (Aug)

2013-10-22 23:00 GMT | AU CB Leading Indicator (Aug)

FOREX NEWS :

2013-10-22 05:15 GMT | Good Chinese data leads to little movement in the markets; traders await US data

2013-10-22 05:09 GMT | Oil sits below $100, gold consolidates

2013-10-22 04:35 GMT | GBP/USD grinds slowly lower ahead of NFP data

2013-10-22 04:12 GMT | NFP likely no to have two-way directionality as usual - Rabobank

---------------------

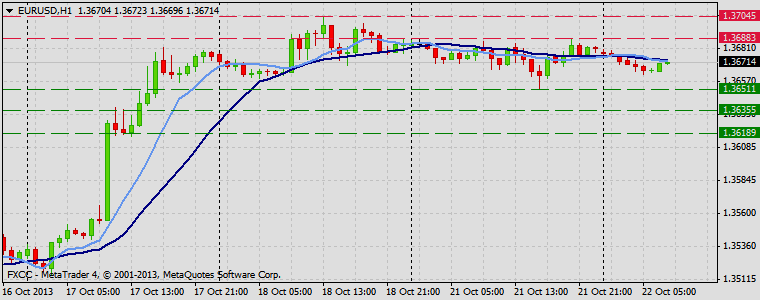

EURUSD :

HIGH 1.36806 LOW 1.36622 BID 1.36711 ASK 1.36713 CHANGE -0.07% TIME 08 : 43:23

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3688 (R1). Breakthrough here would suggest interim target at 1.3704 (R2) and then mark at 1.3721 (R3) acts as next attractive point. Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.3651 (S1) is being able to drive market price towards to our next targets at 1.3635 (S2) and 1.3618 (S3).

Resistance Levels: 1.3688, 1.3704, 1.3721

Support Levels: 1.3651, 1.3635, 1.3618

-------------------

GBPUSD

HIGH 1.61475 LOW 1.61154 BID 1.61274 ASK 1.61277 CHANGE -0.11% TIME 08 : 43:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Retracement formation remains in power. Our next resistive measure lies at 1.6148 (R1), break here is required to achieve higher targets at 1.6173 (R2) and 1.6199 (R3). Downwards scenario: Our bearish expectations remain intact below the key support level at 1.6115 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6090 (S2) and 1.6065 (S3).

Resistance Levels: 1.6148, 1.6173, 1.6199

Support Levels: 1.6115, 1.6090, 1.6065

--------------------

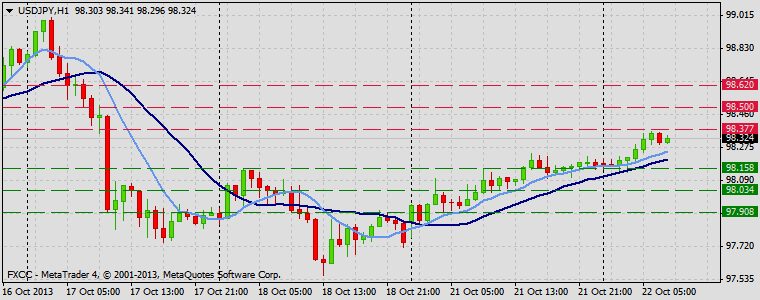

USDJPY :

HIGH 98.364 LOW 98.136 BID 98.311 ASK 98.313 CHANGE 0.14% TIME 08 : 43:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 98.37 (R1), break here would suggest next intraday targets at 98.50 (R2) and 98.62 (R3). Downwards scenario: On the other hand, loss of our support level at 98.15 (S1) would open road for a market decline towards to our next target at 98.03 (S2). Any further price weakening would then be limited to final support at 97.90 (S3).

Resistance Levels: 98.37, 98.50, 98.62

Support Levels: 98.15, 98.03, 97.90

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Tuesday's NFP day, let's be careful out there

The big event of the day is the 18 day late publication of the NFP figures. Traders need to exercise caution as the figure might come in far better than predicted, but be subject to significant revisions due to the temporary govt. shutdown. The anticipation is for a print of 182K jobs created with the unemployment rate remaining steady at 7.3%. The benchmark 10-year yield rose two basis points, or 0.02 percentage point, to 2.60 percent as of 5 p.m in New York. The price of the 2.5 percent note due in August 2023 fell 6/32, or $1.88 per $1,000 face amount, to 99 1/8. The yield declined to 2.54 percent on Oct. 18th, the lowest since July 24th, down from a 2013 high of 3 percent on Sept. 6th.Treasury 10-year notes snapped a three-day advance before the NFP government report on Tuesday.

The yen fell 0.5 percent to 98.19 per dollar after gaining 1.1 percent during the previous two days. Japan’s currency declined 0.4 percent to 134.32 per euro and touched 134.38, the weakest level since Sept. 23rd. The dollar was little changed at $1.3681 per euro after gaining 0.3 percent earlier. The U.S. Dollar Index, which monitors the greenback versus a basket of 10 other major currencies, rose 0.2 percent to 1,004.55 late in New York. The gauge fell to 1,000.70 on Oct. 18th, the lowest intraday level since Feb. 13th, extending a weekly loss to 1 percent, the most in a month. The price of crude oil fell below $100 a barrel Monday after the U.S. government reported an increase in supplies. Metals prices were broadly higher and crop prices were mixed. Crude oil for November delivery fell $1.59, or 1.6 percent, to $99.22 a barrel in New York. That's the first close below $100 a barrel since July.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-22 08:30 GMT | UK Public Sector Net Borrowing (Sep)

2013-10-22 12:30 GMT | US Nonfarm Payrolls (Sep)

2013-10-22 12:30 GMT | CA Retail Sales (MoM) (Aug)

2013-10-22 23:00 GMT | AU CB Leading Indicator (Aug)

FOREX NEWS :

2013-10-22 05:15 GMT | Good Chinese data leads to little movement in the markets; traders await US data

2013-10-22 05:09 GMT | Oil sits below $100, gold consolidates

2013-10-22 04:35 GMT | GBP/USD grinds slowly lower ahead of NFP data

2013-10-22 04:12 GMT | NFP likely no to have two-way directionality as usual - Rabobank

---------------------

EURUSD :

HIGH 1.36806 LOW 1.36622 BID 1.36711 ASK 1.36713 CHANGE -0.07% TIME 08 : 43:23

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Possibility of further price progress is seen above the next resistance level at 1.3688 (R1). Breakthrough here would suggest interim target at 1.3704 (R2) and then mark at 1.3721 (R3) acts as next attractive point. Downwards scenario: As long as price stays below the 20 SMA our technical outlook would be negative. Extension lower the key support level at 1.3651 (S1) is being able to drive market price towards to our next targets at 1.3635 (S2) and 1.3618 (S3).

Resistance Levels: 1.3688, 1.3704, 1.3721

Support Levels: 1.3651, 1.3635, 1.3618

-------------------

GBPUSD

HIGH 1.61475 LOW 1.61154 BID 1.61274 ASK 1.61277 CHANGE -0.11% TIME 08 : 43:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Retracement formation remains in power. Our next resistive measure lies at 1.6148 (R1), break here is required to achieve higher targets at 1.6173 (R2) and 1.6199 (R3). Downwards scenario: Our bearish expectations remain intact below the key support level at 1.6115 (S1). Price penetration below it would allow further declines towards to lower targets at 1.6090 (S2) and 1.6065 (S3).

Resistance Levels: 1.6148, 1.6173, 1.6199

Support Levels: 1.6115, 1.6090, 1.6065

--------------------

USDJPY :

HIGH 98.364 LOW 98.136 BID 98.311 ASK 98.313 CHANGE 0.14% TIME 08 : 43:25

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Instrument gained momentum on the upside recently, turning short-term bias to the positive side. Next resistive structure on the way lies at 98.37 (R1), break here would suggest next intraday targets at 98.50 (R2) and 98.62 (R3). Downwards scenario: On the other hand, loss of our support level at 98.15 (S1) would open road for a market decline towards to our next target at 98.03 (S2). Any further price weakening would then be limited to final support at 97.90 (S3).

Resistance Levels: 98.37, 98.50, 98.62

Support Levels: 98.15, 98.03, 97.90

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Similar topics

Similar topics» Forex Technical & Market Analysis FXCC Apr 25 2013

» Forex Technical & Market Analysis FXCC May 15 2013

» Forex Technical & Market Analysis FXCC Jun 07 2013

» Forex Technical & Market Analysis FXCC Jul 02 2013

» Forex Technical & Market Analysis FXCC Jul 19 2013

» Forex Technical & Market Analysis FXCC May 15 2013

» Forex Technical & Market Analysis FXCC Jun 07 2013

» Forex Technical & Market Analysis FXCC Jul 02 2013

» Forex Technical & Market Analysis FXCC Jul 19 2013

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum