Forex Technical & Market Analysis FXCC Oct 21 2013

Page 1 of 1

Forex Technical & Market Analysis FXCC Oct 21 2013

Forex Technical & Market Analysis FXCC Oct 21 2013

Forex Technical & Market Analysis FXCC Oct 21 2013

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures

Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | US CB Leading Indicator (MoM) (Sep)

2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep)

2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep)

2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11)

FOREX NEWS :

2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755

2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening

2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH

2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750?

----------------------

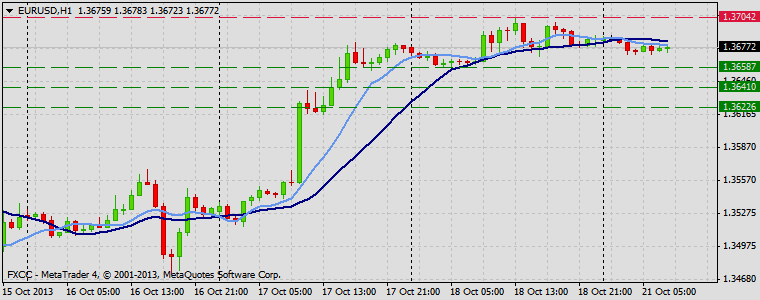

EURUSD :

HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08 : 53:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3).

Resistance Levels: 1.3704, 1.3721, 1.3739

Support Levels: 1.3658, 1.3641, 1.3622

----------------

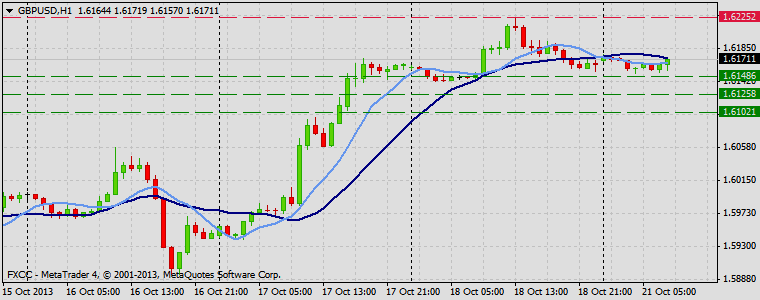

GBPUSD :

HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08 : 53:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3).

Resistance Levels: 1.6225, 1.6248, 1.6269

Support Levels: 1.6148, 1.6125, 1.6102

-----------------------------

USDJPY :

HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08 : 53:05

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential

Resistance Levels: 98.16, 98.31, 98.46

Support Levels: 97.74, 97.59, 97.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

China’s central government has called for “unrelenting” implementation of its economic policies and reform measures

Monday sees the publication of Germany's PPI figure and the monthly report from Germany's Bundesbank. Inflation is expected to come in at 0.1% month on month. In the USA another member of the Fed will hold court with the focus moving from the debt ceiling issue to the other issues affecting the USA economy, such as the throttling of monetary easing by way of tapering. Existing home sales in the USA are expected to come in at 5.31 million from the previous month's 5.48 million. Canada's wholesale sales are anticipated to print at 0.6%. USA crude oil inventory figures are suggested to fall to 3.4 million barrels from 6.8 million barrels the previous month. More arrivals from China contributed to a 7 percent increase in visitors to New Zealand in September 2013, compared with September 2012, Statistics New Zealand said today. "The 21,200 visitors from China was well up from 14,000 last September," population statistics manager Andrea Blackburn said. "This continues the strong growth in visitor numbers which we have seen from the world's most populous country in recent years." In the September 2013 year, visitor arrivals rose 3 percent to reach 2.670 million.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

N/A | US CB Leading Indicator (MoM) (Sep)

2013-10-21 06:00 GMT | DE Producer Price Index (YoY) (Sep)

2013-10-21 14:00 GMT | US Existing Home Sales (MoM) (Sep)

2013-10-21 14:30 GMT | US EIA Crude Oil Stocks change (Oct 11)

FOREX NEWS :

2013-10-21 05:40 GMT | AUD/USD upwards ‘flirting’ with the 200-daily SMA at 0.9755

2013-10-21 05:04 GMT | USD/CHF moves on the upper level on greenback strengthening

2013-10-21 04:23 GMT | USD/JPY looking to test 200-day MA 97.15 - BBH

2013-10-21 03:33 GMT | EUR/USD opens week in the red as part of consolidation; upside eventually 1.3750?

----------------------

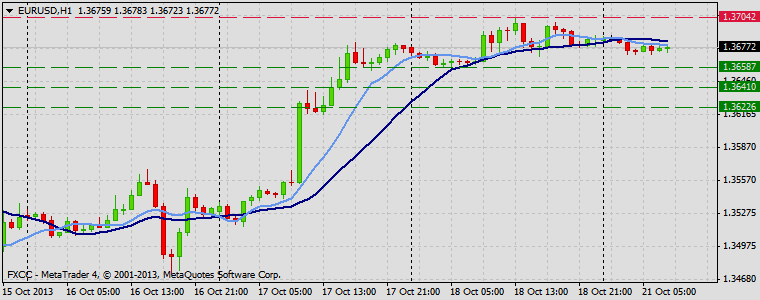

EURUSD :

HIGH 1.36879 LOW 1.36706 BID 1.36776 ASK 1.36779 CHANGE -0.06% TIME 08 : 53:03

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EURUSD clearly determined positive bias on the medium-term perspective. Penetration above the resistive measure at 1.3704 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3721(R2) and 1.3739 (R3). Downwards scenario: Our next supportive measure locates at 1.3658 (S1). Break here is required to enable correction action towards to next target at 1.3641 (S2). Final support for today locates at 1.3622 (S3).

Resistance Levels: 1.3704, 1.3721, 1.3739

Support Levels: 1.3658, 1.3641, 1.3622

----------------

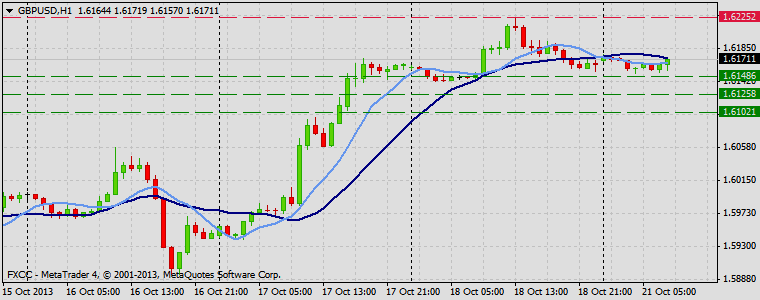

GBPUSD :

HIGH 1.61774 LOW 1.61522 BID 1.61706 ASK 1.61711 CHANGE 0.04% TIME 08 : 53:04

OUTLOOK SUMMARY : Up

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: On the upside fractal level at 1.6225 (R1) prevents further gains. Successful clearance here would suggest next intraday targets at 1.6248 (R2) and 1.6269 (R3). Downwards scenario: On the other hand, current range pattern on the hourly chart suggest possible retest of our supportive measure at 1.6148 (S1). Break here is required to open way towards to initial targets at 1.6125 (S2) and 1.6102 (S3).

Resistance Levels: 1.6225, 1.6248, 1.6269

Support Levels: 1.6148, 1.6125, 1.6102

-----------------------------

USDJPY :

HIGH 98.103 LOW 97.771 BID 98.021 ASK 98.024 CHANGE 0.29% TIME 08 : 53:05

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Low

Upwards scenario: Resistance at 98.16 (R1) limits possible upwards penetration. Break here is required to enable next interim target at 98.31 (R2) en route towards to final aim for today at 98.46 (R3). Downwards scenario: On the other hand, successful retest of our support level at 97.74 (S1) would clear the way for a downtrend expansion towards to our lower targets at 97.59 (S2) and 97.43 (S3) in potential

Resistance Levels: 98.16, 98.31, 98.46

Support Levels: 97.74, 97.59, 97.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Similar topics

Similar topics» Forex Technical & Market Analysis FXCC Apr 17 2013

» Forex Technical & Market Analysis FXCC Oct 31 2013

» Forex Technical & Market Analysis FXCC May 30 2013

» Forex Technical & Market Analysis FXCC Jun 21 2013

» Forex Technical & Market Analysis FXCC Jul 12 2013

» Forex Technical & Market Analysis FXCC Oct 31 2013

» Forex Technical & Market Analysis FXCC May 30 2013

» Forex Technical & Market Analysis FXCC Jun 21 2013

» Forex Technical & Market Analysis FXCC Jul 12 2013

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum