Forex Technical & Market Analysis FXCC Oct 17 2013

Page 1 of 1

Forex Technical & Market Analysis FXCC Oct 17 2013

Forex Technical & Market Analysis FXCC Oct 17 2013

Forex Technical & Market Analysis FXCC Oct 17 2013

Debt ceiling temporary solution provides temporary market relief

The debt ceiling resolution saw the DJIA rise by 1.36% on Wednesday. The compromise will fund the government through to mid-January and raise the debt ceiling through Feb. 7th. It also will set up a budget conference on long-term fiscal issues that would end no later than Dec. 13th. The Treasury Department will still be able to use "extraordinary measures" to work around the debt ceiling in the case that it is not raised by Feb. 7th. The first estimate for the euro area1 (EA17) trade in goods balance with the rest of the world in August 2013 gave a 7.1 billion euro surplus, compared with +4.6 bn in August 2012. The July 20132 balance was +18.0 bn, compared with +13.8 bn in July 2012. In August 2013 compared with July 2013, seasonally adjusted exports rose by 1.0% and imports by 0.2%. Euro area annual inflation was 1.1% in September 2013, down from 1.3% in August. A year earlier the rate was 2.6%. Monthly inflation was 0.5% in September 2013. European Union annual inflation was 1.3% in September 2013, down from 1.5% in August. A year earlier the rate was 2.7%. Monthly inflation was 0.4% in September 2013. The DJIA index closed up 1.36% on Wednesday, the SPX up 1.38% and NASDAQ up 1.20%. The debt ceiling compromise came too late to impact on European markets, STOXX index closed up 0.36%, FTSE up 0.34%, CAC closed down 0.29% and the DAX up 0.47%. The MIB closed up the most by 1.45% on the day.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-17 09:00 GMT | Germany. 10-y Bond Auction

2013-10-17 12:30 GMT | USA. Initial Jobless Claims (Oct 11)

2013-10-17 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey (Oct)

2013-10-17 23:50 GMT | Japan. Foreign bond investment (Oct 11)

FOREX NEWS :

2013-10-17 05:12 GMT | AUD/USD downwards despite a breach of the debt ceiling averted

2013-10-17 04:25 GMT | USD/CHF downwards despite greenback relief rally on debt progress

2013-10-17 02:32 GMT | EUR/USD jumps to 1.3550 highs; targets revisit; House says yes

2013-10-17 02:21 GMT | US House passes bill to end shutdown, raise debt ceiling

-------------------------

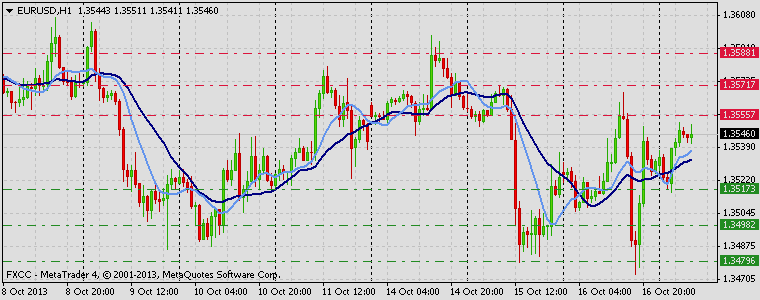

EURUSD :

HIGH 1.35521 LOW 1.35157 BID 1.35468 ASK 1.35473 CHANGE 0.11% TIME 08 : 21:46

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Short- term tendency is bearish even though both moving averages are pointing up. Though risk of market strengthening is seen above the resistance level at 1.3555 (R1). Clearance here would open way towards to next targets at 1.3571 (R2) and 1.3588 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.3517 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.3498 (S2) and 1.3479 (S3).

Resistance Levels: 1.3555, 1.3571, 1.3588

Support Levels: 1.3517, 1.3498, 1.3479

-------------------

GBPUSD :

HIGH 1.59861 LOW 1.59397 BID 1.59775 ASK 1.59785 CHANGE 0.19% TIME 08 : 21:47

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: GBP/USD determined clear sideways tone on the medium-term timeframe. Possibility of market appreciation is seen above the resistance level at 1.5999 (R1). Break here is required to validate next targets at 1.6019 (R2) and 1.6042 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.5938 (S1). Possible price regress could expose our initial targets at 1.5914 (S2) and 1.5892 (S3) in potential.

Resistance Levels: 1.5999, 1.6019, 1.6042

Support Levels: 1.5938, 1.5914, 1.5892

-------------------

USDJPY :

HIGH 99.006 LOW 98.397 BID 98.444 ASK 98.447 CHANGE -0.31% TIME 08 : 21:47

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Instrument consolidates from its initial uptrend formation on the hourly chart. Resistance level at 98.82 (R1) is a key technical point on the upside. Penetration above it would suggest higher targets at 99.01 (R2) and 99.20 (R3) later on today. Downwards scenario: Prolonged movement below the initial support level at 92.28 (S1) might trigger protective orders and drive the price towards to our intraday targets at 98.10 (S2) and 97.89 (S3) later on today.

Resistance Levels: 98.82, 99.01, 99.20

Support Levels: 98.28, 98.10, 97.89

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Debt ceiling temporary solution provides temporary market relief

The debt ceiling resolution saw the DJIA rise by 1.36% on Wednesday. The compromise will fund the government through to mid-January and raise the debt ceiling through Feb. 7th. It also will set up a budget conference on long-term fiscal issues that would end no later than Dec. 13th. The Treasury Department will still be able to use "extraordinary measures" to work around the debt ceiling in the case that it is not raised by Feb. 7th. The first estimate for the euro area1 (EA17) trade in goods balance with the rest of the world in August 2013 gave a 7.1 billion euro surplus, compared with +4.6 bn in August 2012. The July 20132 balance was +18.0 bn, compared with +13.8 bn in July 2012. In August 2013 compared with July 2013, seasonally adjusted exports rose by 1.0% and imports by 0.2%. Euro area annual inflation was 1.1% in September 2013, down from 1.3% in August. A year earlier the rate was 2.6%. Monthly inflation was 0.5% in September 2013. European Union annual inflation was 1.3% in September 2013, down from 1.5% in August. A year earlier the rate was 2.7%. Monthly inflation was 0.4% in September 2013. The DJIA index closed up 1.36% on Wednesday, the SPX up 1.38% and NASDAQ up 1.20%. The debt ceiling compromise came too late to impact on European markets, STOXX index closed up 0.36%, FTSE up 0.34%, CAC closed down 0.29% and the DAX up 0.47%. The MIB closed up the most by 1.45% on the day.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-10-17 09:00 GMT | Germany. 10-y Bond Auction

2013-10-17 12:30 GMT | USA. Initial Jobless Claims (Oct 11)

2013-10-17 14:00 GMT | USA. Philadelphia Fed Manufacturing Survey (Oct)

2013-10-17 23:50 GMT | Japan. Foreign bond investment (Oct 11)

FOREX NEWS :

2013-10-17 05:12 GMT | AUD/USD downwards despite a breach of the debt ceiling averted

2013-10-17 04:25 GMT | USD/CHF downwards despite greenback relief rally on debt progress

2013-10-17 02:32 GMT | EUR/USD jumps to 1.3550 highs; targets revisit; House says yes

2013-10-17 02:21 GMT | US House passes bill to end shutdown, raise debt ceiling

-------------------------

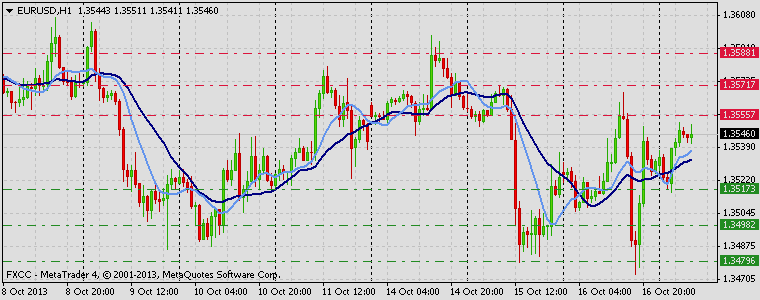

EURUSD :

HIGH 1.35521 LOW 1.35157 BID 1.35468 ASK 1.35473 CHANGE 0.11% TIME 08 : 21:46

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Short- term tendency is bearish even though both moving averages are pointing up. Though risk of market strengthening is seen above the resistance level at 1.3555 (R1). Clearance here would open way towards to next targets at 1.3571 (R2) and 1.3588 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.3517 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.3498 (S2) and 1.3479 (S3).

Resistance Levels: 1.3555, 1.3571, 1.3588

Support Levels: 1.3517, 1.3498, 1.3479

-------------------

GBPUSD :

HIGH 1.59861 LOW 1.59397 BID 1.59775 ASK 1.59785 CHANGE 0.19% TIME 08 : 21:47

OUTLOOK SUMMARY : Down

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: GBP/USD determined clear sideways tone on the medium-term timeframe. Possibility of market appreciation is seen above the resistance level at 1.5999 (R1). Break here is required to validate next targets at 1.6019 (R2) and 1.6042 (R3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.5938 (S1). Possible price regress could expose our initial targets at 1.5914 (S2) and 1.5892 (S3) in potential.

Resistance Levels: 1.5999, 1.6019, 1.6042

Support Levels: 1.5938, 1.5914, 1.5892

-------------------

USDJPY :

HIGH 99.006 LOW 98.397 BID 98.444 ASK 98.447 CHANGE -0.31% TIME 08 : 21:47

OUTLOOK SUMMARY : Down

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Instrument consolidates from its initial uptrend formation on the hourly chart. Resistance level at 98.82 (R1) is a key technical point on the upside. Penetration above it would suggest higher targets at 99.01 (R2) and 99.20 (R3) later on today. Downwards scenario: Prolonged movement below the initial support level at 92.28 (S1) might trigger protective orders and drive the price towards to our intraday targets at 98.10 (S2) and 97.89 (S3) later on today.

Resistance Levels: 98.82, 99.01, 99.20

Support Levels: 98.28, 98.10, 97.89

Source: FX Central Clearing Ltd,( http://www.fxcc.com )

Similar topics

Similar topics» Forex Technical & Market Analysis FXCC Apr 12 2013

» Forex Technical & Market Analysis FXCC May 03 2013

» Forex Technical & Market Analysis FXCC May 24 2013

» Forex Technical & Market Analysis FXCC Jun 18 2013

» Forex Technical & Market Analysis FXCC Jul 09 2013

» Forex Technical & Market Analysis FXCC May 03 2013

» Forex Technical & Market Analysis FXCC May 24 2013

» Forex Technical & Market Analysis FXCC Jun 18 2013

» Forex Technical & Market Analysis FXCC Jul 09 2013

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum