Forex Technical & Market Analysis FXCC Dec 19 2013

Page 1 of 1

Forex Technical & Market Analysis FXCC Dec 19 2013

Forex Technical & Market Analysis FXCC Dec 19 2013

Forex Technical & Market Analysis FXCC Dec 19 2013

After the USA FOMC taper tantrum focus now shifts back to key fundamentals such as the USA claimant count

Thursday we receive data on Europe's balance of payments which is predicted to print at €14.2 billion positive. Retail sales in the UK are predicted to come in at 0.3% up on the month. USA unemployment claims are predicted in at 336K, down from 368K, existing home sales are predicted in at 5.04 million annual rate, a slight seasonal fall from the previous month. The Philly Fed manufacturing index is predicted to come in at 10.3, significantly up from 6.5 the previous month. Natural gas storage data is printed for the USA. Last week was down -81bn. Late evening Japan publishes its monetary policy statement and the Bank of Japan holds a press conference. The U.S. Dollar Index, which monitors the greenback versus its 10 major counterparts, gained 0.5 percent to 1.021.53 late in New York Wednesday. The greenback added 1.4 percent to 104.12 yen, the highest level since Oct. 6, 2008. The U.S. currency advanced 0.6 percent to $1.3685 versus Europe’s 17-nation euro. The dollar rose to a five-year high versus the yen after the Federal Reserve officials voted to reduce monthly asset purchases that are seen as debasing the U.S. currency amidst signs that economic growth is strengthening. The DJIA closed up 1.84% on Wednesday, a new record high at 16167, the SPX closed up 1.66% and the NASDAQ up 1.15%. In Europe STOXX closed up 1.13%, CAC up 1.00%, DAX up 1.06% and the FTSE up 0.09%. Looking towards Thursday the equity index future for the DJIA is up 1.89%, SPX up 1.79%, NASDAQ future up 1.38%. Euro STOXX equity index future is up 0.88%, DAX up 0.88%, CAC up 0.97%, FTSE up 0.02%. NYMEX WTI oil closed the day up 0.60% at $97.80 per barrel, NASDAQ nat gas down 0.30% at $4.27 per therm, COMEX gold up 0.40% at $1235.00 per ounce with silver on COMEX down 0.66% at $19.71 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-19 09:30 GMT | UK. Retail Sales (YoY) (Nov)

2013-12-19 13:30 GMT | US. Initial Jobless Claims (Dec 13)

2013-12-19 14:00 GMT | Switzerland. SNB Quarterly Bulletin (Q3)

2013-12-19 15:00 GMT | US. Existing Home Sales Change (MoM) (Nov)

FOREX NEWS :

2013-12-19 05:34 GMT | GBP/AUD remains at multi-year highs just above 1.8500; next long-term target is 1.9670

2013-12-19 05:17 GMT | EUR/USD extends bearish bias, 1.3615 support eyed

2013-12-19 04:47 GMT | EUR/JPY pulling back early Thursday after big up day Wednesday; next upside target 145.76

2013-12-19 03:11 GMT | GBP/USD may have completed 5th wave higher Wednesday at 1.6483; 1st pullback target 1.6089

EURUSD :

HIGH 1.36939 LOW 1.36493 BID 1.36744 ASK 1.36747 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EUR extended its decline versus the USD and determined negative short-term technical outlook. However above the resistance at 1.3697 (R1) opens a route towards to next resistive measures at 1.3715 (R2) and 1.3731 (R3). Downwards scenario: Next support level is seen at 1.3656 (S1), any penetration below it might activate downside pressure and enable lower target at 1.3634 (S2). Any further market decline would then be limited to 1.3615 (S3).

Resistance Levels: 1.3697, 1.3715, 1.3731

Support Levels: 1.3656, 1.3634, 1.3615

-----------------

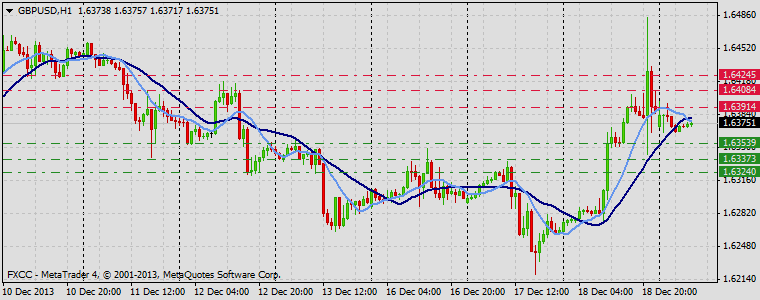

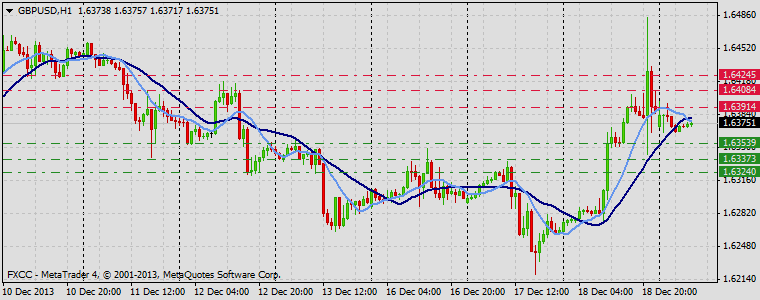

GBPUSD :

HIGH 1.63972 LOW 1.63656 BID 1.63763 ASK 1.63768 CHANGE 0% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: The possibility of an upside price progress is seen above the resistance level at 1.6391 (R1). Evaluation above this mark might initiate bullish pressure and expose medium-term interim targets at 1.6408 (R2) and 1.6424 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 1.6353 (S1). Loss here might change intraday technical structure and opens the way for a test of 1.6337 (S2) and 1.6324 (S3) later on today.

Resistance Levels: 1.6391, 1.6408, 1.6424

Support Levels: 1.6353, 1.6337, 1.6324

------------------

USDJPY :

HIGH 104.363 LOW 103.782 BID 104.006 ASK 104.009 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upside risk aversion is seen above the next resistance level at 104.36 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 104.60 (R2) and 104.83 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 103.83 (S1). Clearance here would suggest lower targets at 103.54 (S2) and 103.24 (S3) in potential.

Resistance Levels: 104.36, 104.60, 104.83

Support Levels: 103.83, 103.54, 103.24

Source: FX Central Clearing Ltd,( ECN Forex Broker | ECN Forex Trading Platform | Foreign Currency Exchange | Best Currency Online Trading | FXCC )

After the USA FOMC taper tantrum focus now shifts back to key fundamentals such as the USA claimant count

Thursday we receive data on Europe's balance of payments which is predicted to print at €14.2 billion positive. Retail sales in the UK are predicted to come in at 0.3% up on the month. USA unemployment claims are predicted in at 336K, down from 368K, existing home sales are predicted in at 5.04 million annual rate, a slight seasonal fall from the previous month. The Philly Fed manufacturing index is predicted to come in at 10.3, significantly up from 6.5 the previous month. Natural gas storage data is printed for the USA. Last week was down -81bn. Late evening Japan publishes its monetary policy statement and the Bank of Japan holds a press conference. The U.S. Dollar Index, which monitors the greenback versus its 10 major counterparts, gained 0.5 percent to 1.021.53 late in New York Wednesday. The greenback added 1.4 percent to 104.12 yen, the highest level since Oct. 6, 2008. The U.S. currency advanced 0.6 percent to $1.3685 versus Europe’s 17-nation euro. The dollar rose to a five-year high versus the yen after the Federal Reserve officials voted to reduce monthly asset purchases that are seen as debasing the U.S. currency amidst signs that economic growth is strengthening. The DJIA closed up 1.84% on Wednesday, a new record high at 16167, the SPX closed up 1.66% and the NASDAQ up 1.15%. In Europe STOXX closed up 1.13%, CAC up 1.00%, DAX up 1.06% and the FTSE up 0.09%. Looking towards Thursday the equity index future for the DJIA is up 1.89%, SPX up 1.79%, NASDAQ future up 1.38%. Euro STOXX equity index future is up 0.88%, DAX up 0.88%, CAC up 0.97%, FTSE up 0.02%. NYMEX WTI oil closed the day up 0.60% at $97.80 per barrel, NASDAQ nat gas down 0.30% at $4.27 per therm, COMEX gold up 0.40% at $1235.00 per ounce with silver on COMEX down 0.66% at $19.71 per ounce.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-19 09:30 GMT | UK. Retail Sales (YoY) (Nov)

2013-12-19 13:30 GMT | US. Initial Jobless Claims (Dec 13)

2013-12-19 14:00 GMT | Switzerland. SNB Quarterly Bulletin (Q3)

2013-12-19 15:00 GMT | US. Existing Home Sales Change (MoM) (Nov)

FOREX NEWS :

2013-12-19 05:34 GMT | GBP/AUD remains at multi-year highs just above 1.8500; next long-term target is 1.9670

2013-12-19 05:17 GMT | EUR/USD extends bearish bias, 1.3615 support eyed

2013-12-19 04:47 GMT | EUR/JPY pulling back early Thursday after big up day Wednesday; next upside target 145.76

2013-12-19 03:11 GMT | GBP/USD may have completed 5th wave higher Wednesday at 1.6483; 1st pullback target 1.6089

EURUSD :

HIGH 1.36939 LOW 1.36493 BID 1.36744 ASK 1.36747 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: EUR extended its decline versus the USD and determined negative short-term technical outlook. However above the resistance at 1.3697 (R1) opens a route towards to next resistive measures at 1.3715 (R2) and 1.3731 (R3). Downwards scenario: Next support level is seen at 1.3656 (S1), any penetration below it might activate downside pressure and enable lower target at 1.3634 (S2). Any further market decline would then be limited to 1.3615 (S3).

Resistance Levels: 1.3697, 1.3715, 1.3731

Support Levels: 1.3656, 1.3634, 1.3615

-----------------

GBPUSD :

HIGH 1.63972 LOW 1.63656 BID 1.63763 ASK 1.63768 CHANGE 0% TIME 08 : 37:24

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: The possibility of an upside price progress is seen above the resistance level at 1.6391 (R1). Evaluation above this mark might initiate bullish pressure and expose medium-term interim targets at 1.6408 (R2) and 1.6424 (R3). Downwards scenario: On the short-term perspective the pair might encounter supportive measures at 1.6353 (S1). Loss here might change intraday technical structure and opens the way for a test of 1.6337 (S2) and 1.6324 (S3) later on today.

Resistance Levels: 1.6391, 1.6408, 1.6424

Support Levels: 1.6353, 1.6337, 1.6324

------------------

USDJPY :

HIGH 104.363 LOW 103.782 BID 104.006 ASK 104.009 CHANGE 0.01% TIME 08 : 37:24

OUTLOOK SUMMARY : Up

TREND CONDITION : Up trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Medium

Upwards scenario: Upside risk aversion is seen above the next resistance level at 104.36 (R1). Appreciation above it might lead to the positive intraday bias formation towards to our next targets at 104.60 (R2) and 104.83 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 103.83 (S1). Clearance here would suggest lower targets at 103.54 (S2) and 103.24 (S3) in potential.

Resistance Levels: 104.36, 104.60, 104.83

Support Levels: 103.83, 103.54, 103.24

Source: FX Central Clearing Ltd,( ECN Forex Broker | ECN Forex Trading Platform | Foreign Currency Exchange | Best Currency Online Trading | FXCC )

Similar topics

Similar topics» Forex Technical & Market Analysis FXCC Nov 08 2013

» Forex Technical & Market Analysis FXCC May 14 2013

» Forex Technical & Market Analysis FXCC Jun 06 2013

» Forex Technical & Market Analysis FXCC Jul 01 2013

» Forex Technical & Market Analysis FXCC Jul 18 2013

» Forex Technical & Market Analysis FXCC May 14 2013

» Forex Technical & Market Analysis FXCC Jun 06 2013

» Forex Technical & Market Analysis FXCC Jul 01 2013

» Forex Technical & Market Analysis FXCC Jul 18 2013

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum